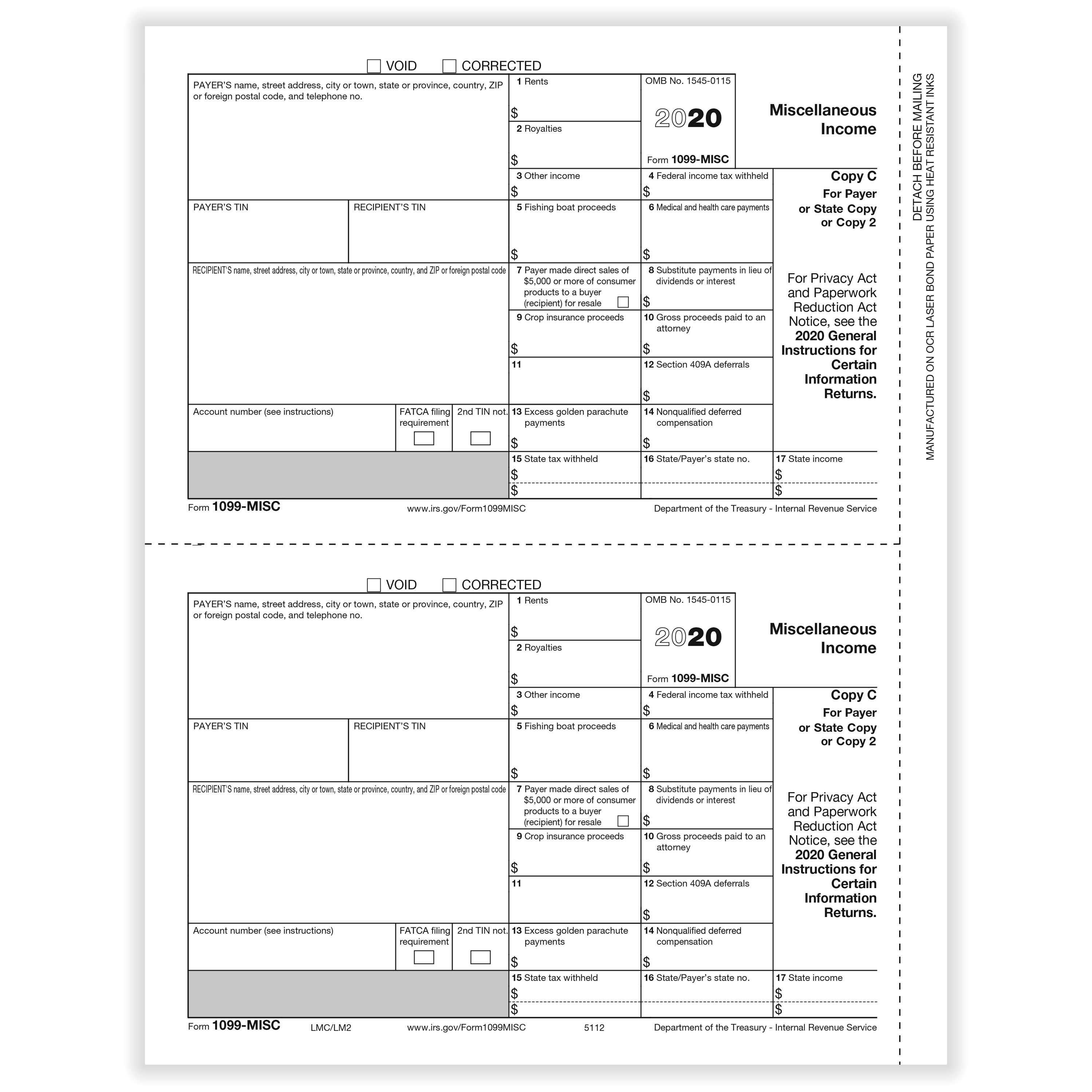

Form 1099-MISC is used to report miscellaneous payments such as rent, awards, royalties, medical and health care payments, and more. Anyone who has paid at least $600 in one of these categories in the past year will typically use a 1099-MISC form. A 1099 is used to report certain payments made to non-employees, such as freelance or contract work, to the IRS as part of an information return about your business. While the Achieving a Better Life Experience (ABLE) Act exempts tax payments on distributions received for settling disability-related expenses, you’re expected to document the amounts received. Even if the distributions were terminated, established institutions will send you Form 1099-QA.

Correcting errors on 1099 Forms

Some types of bartering transactions executed through a barter exchange would also be listed and reported on a 1099–B form. Since the 1099-H form is no longer used, you won’t receive it for tax years beyond 2021. However, if you need a copy from 2021 or earlier, you may still be able to find it through your insurance coverage provider. It is important to note that each situation is unique and should be evaluated on a case-by-case basis. The information provided here is intended as a general guide and may not apply to all scenarios. For specific advice, it is recommended to consult a tax professional or the Internal Revenue Service (IRS).

Step 1: Understand the 1099 form

However, it is important to note that the payer or employer should still keep records of the reimbursed expenses and may need to report them separately to the IRS. Additionally, if the expenses are not properly substantiated or do not meet the other requirements of an accountable plan, they may lose their tax-exempt status and become taxable income for the recipient. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a Form 1099. The IRS considers someone an independent contractor if they are self-employed or if a business contracts them to perform work as a nonemployee. Small business owners have a number of tasks to complete during tax season, and one important step is providing 1099 forms to independent contractors. Before understanding how to fill out a 1099 form, you’ll need to identify workers who are contractors, understand the process for completing a 1099-NEC form, and submit the forms properly.

Payroll Service For Small Business

If you’re self-employed and have several clients, you should receive a 1099-MISC from each client who paid you $600 or more. Issuers of 1099 forms must send one copy to the IRS and another to the taxpayer, the income recipient. For tax year 2023 and earlier, this form is issued when annual third-party network processing activity what are 1099s exceeds $20,000 and 200 individual transactions. For 2024, the threshold amount is expected to be $5,000 with no regard to the number of transactions. To avoid these issues, accurately report all income, including 1099 income, on your tax return. This form is used for withdrawals from an individual retirement account.

For example, if a company acquired another company, and part of that company’s assets included life insurance holdings, the policy sale needs to be reported. For some taxpayers, the majority (or even all) of their earnings in a given year will be 1099 income. Examples include someone who lives mostly off of Social Security income (SSA-1099), investment withdrawals (1099-B, 1099-DIV) or retirement account withdrawals (1099-R). Taxpayers who are unsure about the amount of income earned or how that income should be reported should seek help from a tax professional.

The IRS also refers to them as “information returns.” Here’s a basic rundown of the Form 1099s most likely to cross your path. However, simply receiving a 1099 tax form doesn’t necessarily mean you owe taxes on that money. You might have deductions that offset the income, or some or all of it might be sheltered based on the characteristics of the asset that generated it. You’ll need your 1099 to accurately report your income on your tax return. Remember that a copy of this form is also sent to the IRS, so you can be sure the agency knows about this income. If you’re generating certain nonwage income this year, keep an eye out for a 1099 form in your inbox by early next year.

Likewise, sole proprietors should report any 1099 income they’ve earned on Schedule C of Form 1040. This 1099 reports the “acquisition or abandonment of secured property.” This basically means that you walked away from a property, relinquishing it to the lender in lieu of paying a debt. You’ll receive this form even if you gave up some, but not all, of your ownership interest in the property.

Workers who receive 1099s usually haven’t had money withheld for taxes and need to calculate how much tax they owe themselves. These often include actors, musicians, writers, consultants, lawyers, accountants, plumbers, building tradesmen, gardeners and other independent workers that receive compensation on a per-job basis. The form is used to report income, proceeds, etc., only on a calendar year (January 1 through December 31) basis, regardless of the fiscal year used by the payer or payee for other Federal tax purposes. You will receive Form 1099-R if you received a distribution of retirement benefits from a retirement plan, even if it was only $10. You’ll also receive Form 1099-R if you initiate a rollover of your plan from one custodian to another, though this is not considered a taxable event. Payments from the federal, state, or local government of $10 or more for credits, refunds, or offsets are reported to the IRS using Form 1099-G.

The taxpayer might be able to report it under miscellaneous income if they haven’t received the expected 1099 for income earned even if the business didn’t file the 1099 form. If you are a contractor, reimbursements for travel expenses are generally included on a 1099 MISC form. However, reimbursements are not included on a 1099 MISC form if they are paid under an accountable plan. This is because, under an accountable plan, reimbursements for expenses with a “business connection” are excluded from an individual’s wages and are not subject to withholding or reporting.

- Form 1099-A documents “acquisition or abandonment of secured property.” If you lost a property to foreclosure, your lender will send you this form so you can document capital losses.

- This dividend income does not apply to dividends accrued in tax-sheltered retirement accounts, such as a 401(k) or IRA.

- Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service.

- The most common use of Form 1099-MISC is to report rent payments while Form 1099-NEC is used to report payments made to independent contractors for services provided to a business.

You might have been making contributions to one or more retirement funds throughout your working life. You didn’t pay income tax on any contributions you made to traditional plans, such as a 401(k), although any contributions to Roth plans were made with with after-tax dollars. You’ll receive a 1099-R if and when you take distributions from any of your traditional retirement savings plans. You must report the distributions as income in the year you take them. This form must be issued for healthcare services provided and for legal services delivered by attorneys.

A 1099-DIV is typically sent to a taxpayer if dividend income was earned during the tax year. Dividends are usually in the form of cash payments paid to investors by corporations as a reward for owning their stock or equity shares. If these requirements are met, reimbursements for travel expenses do not need to be included as nonemployee compensation on a 1099 MISC form. However, if reimbursements are part of services (e.g., supplies, parts, materials incidental to providing a service), then they may be included in the 1099 MISC form. Reimbursed travel expenses are generally not reported on a 1099 if they are made under an accountable plan.